ta code examples

0

Contents

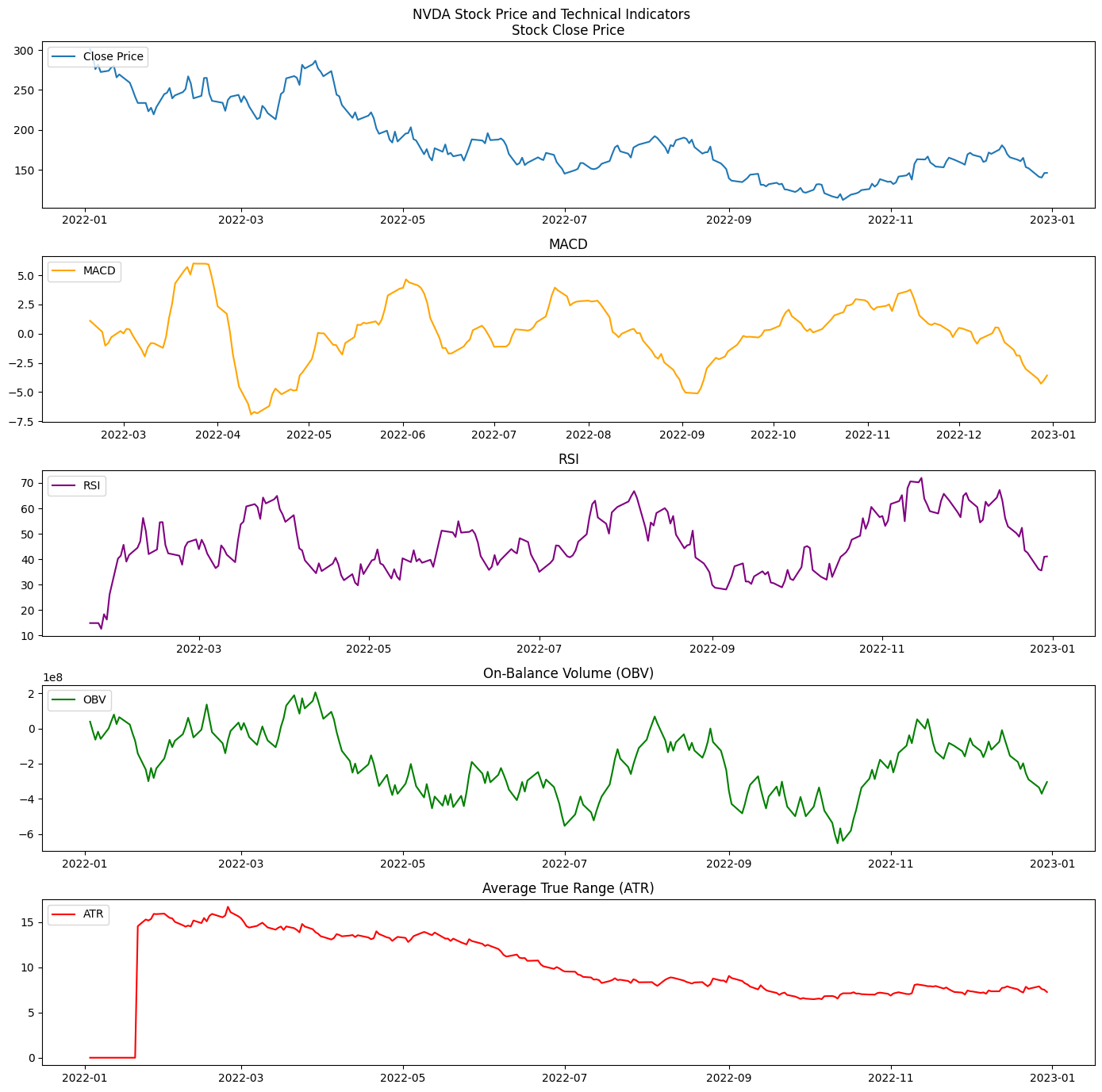

This python code example will show you how to use the ta python package to perform technical analysis on historical stock data such as RSI, SMA, Bollinger Bands, and Stochastic Oscillator.

The code uses yfinance to download 12 months of price data for Nvidia (NVDA) and then calculates each of the technical analysis indicators using the ta library. Finally, the code example uses matplotlib to plot all of the data.

Source Code

# Import necessary libraries

import yfinance as yf

import ta

import matplotlib.pyplot as plt

# Download historical data for desired ticker symbol

df = yf.download('NVDA', start='2022-01-01', end='2023-01-01')

# Calculate Simple Moving Average (SMA)

df['SMA'] = ta.trend.sma_indicator(df['Close'], window=14)

# Calculate Exponential Moving Average (EMA)

df['EMA'] = ta.trend.ema_indicator(df['Close'], window=14)

# Calculate Moving Average Convergence Divergence (MACD)

df['MACD'] = ta.trend.macd_diff(df['Close'])

# Calculate Relative Strength Index (RSI)

df['RSI'] = ta.momentum.rsi(df['Close'], window=14)

# Calculate Bollinger Bands

df['BB_High'] = ta.volatility.bollinger_hband(df['Close'])

df['BB_Low'] = ta.volatility.bollinger_lband(df['Close'])

# Calculate On-Balance Volume (OBV)

df['OBV'] = ta.volume.on_balance_volume(df['Close'], df['Volume'])

# Calculate Money Flow Index (MFI)

df['MFI'] = ta.volume.money_flow_index(df['High'], df['Low'], df['Close'], df['Volume'])

# Calculate Stochastic Oscillator

df['Stochastic_Oscillator'] = ta.momentum.stoch(df['High'], df['Low'], df['Close'])

# Calculate Average True Range (ATR)

df['ATR'] = ta.volatility.average_true_range(df['High'], df['Low'], df['Close'])

# Plotting

fig, axs = plt.subplots(5, figsize=(14, 14))

fig.suptitle('NVDA Stock Price and Technical Indicators')

# Plot stock close price

axs[0].plot(df.index, df['Close'], label='Close Price')

axs[0].set_title('Stock Close Price')

axs[0].legend(loc='upper left')

# Plot MACD

axs[1].plot(df.index, df['MACD'], label='MACD', color='orange')

axs[1].set_title('MACD')

axs[1].legend(loc='upper left')

# Plot RSI

axs[2].plot(df.index, df['RSI'], label='RSI', color='purple')

axs[2].set_title('RSI')

axs[2].legend(loc='upper left')

# Plot OBV

axs[3].plot(df.index, df['OBV'], label='OBV', color='green')

axs[3].set_title('On-Balance Volume (OBV)')

axs[3].legend(loc='upper left')

# Plot ATR

axs[4].plot(df.index, df['ATR'], label='ATR', color='red')

axs[4].set_title('Average True Range (ATR)')

axs[4].legend(loc='upper left')

# Show the plot

plt.tight_layout()

plt.show()

Output Plot

With just a few lines of code, we can fetch historical stock data, calculate technical indicators, and visualize the results, making it an invaluable tool for financial analysts and algorithmic traders alike.

About ta

ta - A Technical Analysis Library in Python.

pythonfix

pythonfix